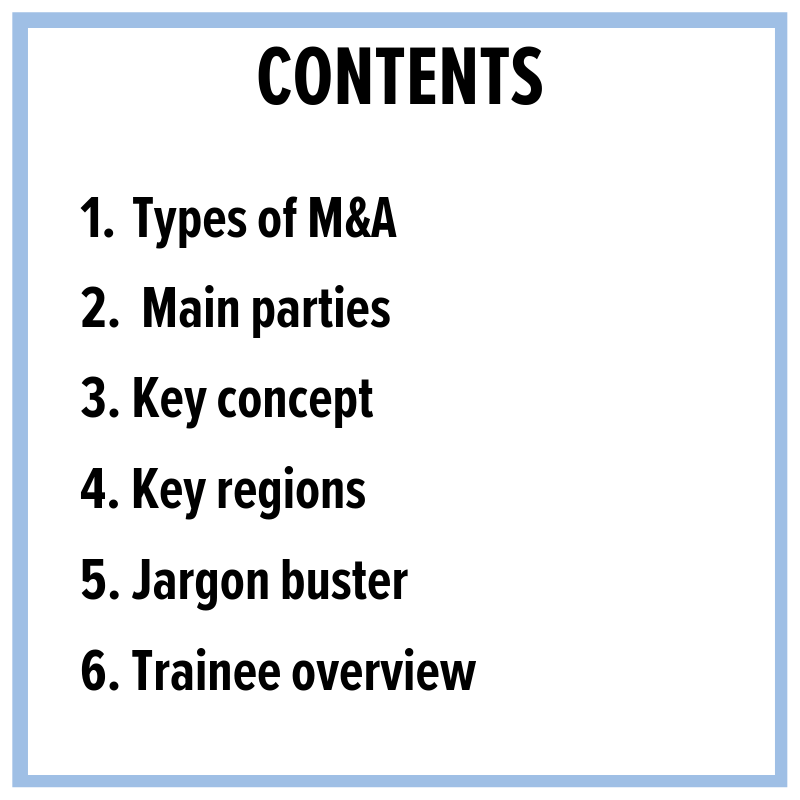

Information hub

All the latest views and news here

A Student’s Guide to Mergers & Acquisitions

If you complete a training contract at a city law firm, there is a strong chance you could spend some time in the mergers & acquisitions (M&A) department.

M&A work is a popular choice for trainees and many solicitors working at commercial law firms will specialise in M&A work. In this blog, we’ll give you an overview of this practice area.

1. TYPES OF M&A

Public M&A

Mergers and acquisitions of companies whose shares are traded on a public stock exchange and held by a number of shareholders. The London Stock Exchange (“LSE”) operates two principal markets in the UK: the Main Market and the Alternative Investment Market (“AIM”). The Main Market is made up of ‘premium’ and ‘standard’ listing regimes.

A premium listing is typically used by large firms looking to benefit from an increased profile and highly liquid market (i.e. a market on which shares are easily traded). To be eligible for inclusion on the FTSE indexes, a company must be premium listed.

Companies with standard listings only have to comply with minimum listing requirements and they pay lower fees than companies with premium listings.

AIM is the LSE’s exchange for smaller and growing organisations. It has a simplified regulatory environment designed for the needs of small and emerging companies.

There are many rules and regulations governing companies that are listed on a public stock exchange so as to protect investors. In the UK, these include the Listing Rules, the AIM Rules, the Takeover Code, the Prospectus Rules and the Disclosure and Transparency Rules.

The Listing Rules lay down: (i) the minimum requirements for the admission of securities to listing on the Main Market; (ii) the content, scrutiny and publication of listing particulars; and (iii) the continuing obligations of companies after admission. The AIM rules set out the rules and responsibilities in relation to AIM companies.

The Takeover Code is the key regulation governing takeovers of public companies in the UK. It aims to ensure: (i) shareholders receive fair and equal treatment; (ii) shareholders are not denied an opportunity to decide on the merits of a takeover – they must have adequate information to reach a properly informed decision; and (iii) the target is not hindered in conduct of its affairs for longer than is reasonable. The Code applies from the point at which the bid is first actively considered and it regulates the offer terms, timetable and dealings in the securities of the target as well as documentation, public statements and associated disclosures.

All companies listed on the LSE require the issue of a prospectus (i.e. an offer document for their listed securities), unless an exemption applies. The Prospectus Rules set out the form, content and approval requirements for prospectuses.

The Disclosure and Transparency Rules govern the ongoing obligations of listed companies as regards disclosure of information to the market.

Private M&A

Mergers and acquisitions of companies whose shares are owned by private individuals or other companies, and which are not traded on a public stock exchange. There are fewer rules and regulations governing private transactions than public transactions.

When acquiring a company, the articles of association and, if applicable, the shareholders’ agreement need to be checked for any rights/ obligations that shareholders have relating to the transfer of shares. For example there may be a requirement for shareholders to first offer to sell their shares to other shareholders before making an offer to an outside third party, this is known as a pre-emption right.

Typically, a private company is acquired by buying all of the issued and to be issued share capital. An obvious advantage of buying the share capital of a company is that all of the assets of the target company are thereby acquired and there will generally be no need for consultation with third parties or consents to assignments of contracts. However, a share acquisition will also result in all the liabilities of the target being acquired as well. It is therefore vital that appropriate due diligence is carried out and a comprehensive list of warranties (and/or indemnities) is obtained.

Alternatively, private companies can be acquired by buying most/all of the assets of that company. Not all assets and liabilities will automatically transfer, therefore assignments of contracts and novations of liabilities are usually required. To the extent that an asset is not specifically included, or a liability is not specifically assumed, in connection with the asset sale, the buyer will not get title to the asset or the seller will be left with the liability.

There are usually no or very limited requirements to inform and/or consult trade unions/employee representatives on a share sale, whereas on an asset sale there will usually be requirements under the Transfer of Undertakings (Protection of Employment) Regulations 2006 (“TUPE”) to inform and consult such persons.

Private Equity

Acquisition of private companies by private equity houses which run an investment portfolio, with a view to improving the business of the companies acquired and then sell them on at a profit.

In Europe, private equity is a term which covers a range of transactions in which the source of finance are high net worth individuals and firms who are investing specifically in unquoted securities rather than in publicly quoted securities or government bonds. These investors buy shares of private companies—or gain control of public companies with the intention of taking them private and ultimately delisting them from public stock exchanges.

Large institutional investors dominate the private equity world, including pension funds and large private equity firms funded by a group of accredited investors. Private equity, as an umbrella term, also includes venture capital and management buy-ins and management buyouts.

Private equity firms mostly buy mature companies that are already established. The companies may be deteriorating or not making the profits they should be due to inefficiency. Private equity firms buy these companies and streamline operations to increase revenues.

Venture capital firms, on the other hand, mostly invest in startups with high growth potential who are seeking substantial funds for the first time. Venture capital does not always take a monetary form; it can also be provided in the form of technical or managerial expertise.

A management buyout (“MBO”) is the acquisition of a company by the company’s management team which is supported by private equity investment and/or debt financing. MBOs are favoured exit strategies for large corporations that wish to sell parts of their business that are not core to their business strategy.

A management buy-in (“MBI”) is when a management group from outside the company leads the acquisition of the company and replaces the existing management team. Both MBOs and MBIs often require a substantial amount of money, and funding will usually come from a mixture of personal resources, private equity financiers, and seller financing.

Where an MBO is supported by a private equity fund, the private equity will, given that there is a dedicated management team in place, likely pay an attractive price for the asset. While private equity funds do participate in MBOs, their preference may be for MBIs, where the companies are run by managers that they know rather than the incumbent management team.

2. Main Parties

Purchaser: the party making the acquisition by signing the relevant documents and paying the agreed purchase price, and who then directly or indirectly owns or controls the target company’s shares or assets (depending on what is sold) once the transaction closes.

Seller: the party selling the shares or assets, being either the private company or persons who own such shares or assets, or the Board of Directors and management team in a public company.

Target: the company that is the subject of a merger or acquisition attempt.

Advisers: key advisers on the purchaser and seller side of the transaction, including lawyers to advise on the content of key contracts, structuring of the transaction and timing of the transaction, as well as specialist financial and tax advisers.

Management (relevant to Private Equity transactions): directors and key senior employees of the Target company, who may invest together with the Purchaser in the acquisition of the Target company or alternatively be involved in selling the Target company.

3. Key Concept – Due Dilligence

Due diligence is the focused legal investigation of a target company and it is fundamental to all M&A transactions. The onus is on the purchaser to find out everything it wants or needs to know about a company prior to its acquisition as there is no legal obligation on the seller to disclose information unless the buyer specifically requests it.

The purpose of due diligence is to identify key strengths and weaknesses to allow the purchaser to weigh up the assets against the risks and to correctly ascertain what the purchase price should be.

Diligence takes place early on in negotiations and should place the purchaser in a position to (i) decide whether or not to proceed with an acquisition; (ii) negotiate a deal with the vendor; (iii) formulate acquisition documentation; (iv) plan post-acquisition strategies; and (v) account for third party interests.

The results of the diligence process will determine the representations, warranties, indemnities and guarantees that are given when parties are negotiating the sale/purchase of a business.

4. Key Regions

Often, the parties to M&A transactions are part of complex structures that have subsidiary companies with branches or employees in many different countries across the world. Therefore, M&A transactions often span multiple jurisdictions in multiple regions.

To conduct due diligence on a company that has subsidiaries in different jurisdictions, local counsel (i.e. counsel from the country in which the subsidiary has its registered office) will need to be instructed to investigate the documents pertaining to that company’s existence and any transaction documents for that subsidiary that have been drawn up in accordance with that country’s legal system.

5. Jargon Buster

Merger: the combination of two companies to form a new company. Both companies’ stocks are surrendered and new company stock is issued in its place.

Acquisition: the purchase of one company by another in which no new company is formed and the target company ceases to exist.

Asset Purchase: the purchase of individual assets that make up the target business.

Share Purchase: the purchase of shares in the company that own the target business or assets.

Recommended Takeover: a takeover bid where target shareholders are recommended to accept the offer by the target directors.

Hostile Takeover: a takeover bid where target shareholders are not recommended to accept the offer by the target directors.

Auction: a sale process in which a seller solicits competing bids for a target company or business. In an auction sale, the seller controls the sale process and can therefore maximise the purchase price and negotiate more favourable deal terms.

Joint Venture: a business arrangement in which two or parties agree to pool their resources for the purpose of accomplishing a specific task. In a joint venture, each of the participants is responsible for profits, losses and costs associated with it. The venture is its own entity, i.e. a company or a partnership, that is separate from the participants’ other business interests. The resources that are pooled from the parties as part of the joint venture can constitute assets taken from either party, financial assistance, or a mixture of both.

Limited Liability Company: a business structure where members or shareholders have their liability limited to the contributions which they have made or invested in the company. There are three types of limited companies in the UK: (i) private limited companies (Ltd); (ii) companies limited by guarantee (Ltd); and (iii) public limited companies (PLC).

Company Limited by Guarantee: these companies have no share capital and have members rather than shareholders. The members undertake to contribute a predetermined nominal sum to the liabilities of the company which becomes due in the event of the company being wound up.

Partnership: the relationship which subsists between two or more persons carrying on a business in common with a view to profit.

Limited Partnership: is a partnership with two categories of partner: one or more general partners who manage the business of the partnership and one or more limited partners who do not participate in the management of the partnership and who have limited liability.

Limited Liability Partnership: a hybrid form of business entity: it is neither a partnership nor a company. An LLP is a body corporate and therefore a separate legal entity and an LLP member’s liability is limited. However, like a partnership the relationship between the LLP members is governed by private agreement. An LLP does not have shareholders or directors and is taxed like a partnership.

Articles of Association: the document which forms the company’s constitution and sets out the basic management and administrative structure of the company. The articles regulate the internal affairs of the company including: (i) the issue and transfer of shares; (ii) board and shareholder meetings; (iii) powers and duties of directors; (iv) payment of dividends; and (v) borrowing. The articles are a public document made available at Companies House. They create a contract between the company and each of its members in their capacity as members.

Shareholders’ Agreement: is an agreement entered into between all or some of the shareholders of the company. It regulates the relationship between the shareholders, the management of the company and concerns ownership of the shares, the protection of the shareholders and the way in which the company is run.

Partnership Agreement: is a written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it defines: (i) the nature of the business; (ii) capital contributed by each partner; and (iii) the rights and responsibilities of each partner.

Non-Disclosure Agreement: a binding legal agreement between parties which is used where each party is disclosing information to the other and wants to impose obligations on the other party to keep that information confidential.

Sale and Purchase Agreement: is a legal contract that obligates a buyer to buy and a seller to sell. The SPA represents the outcome of key commercial and pricing negotiations when buying or selling whole, or parts of, companies and/or partnerships.

Lock-out Agreement: agreement preventing the seller from actively seeking or negotiating with other prospective buyers for a specified period, thereby giving the buyer a period of exclusivity in which to negotiate.

Corporate Guarantee: is a promise by one party (the “Guarantor”) to ensure that another party fulfils its obligations and/or a promise by one party to fulfil those obligations if the other party fails to do so. It is a contractual agreement that creates a secondary obligation to support a primary obligation of one party to another. If the obligations of the third party for which the Guarantor has promised to be responsible fall away, the guarantee will also fall away.

Indemnities: are like guarantees in that they are a promise by one party (the “Indemnifier”) to be responsible for another party’s losses. However, unlike a guarantee, an indemnity is a primary obligation that is not reliant on the obligations of the third party. If the obligations of the third party for whose losses the Indemnifier is responsible fall away, the indemnity will remain in place.

Representations: are assertions as to fact, true on the date that the representation is made. They are given to induce another party to enter into a contract or take some other action. If a representation is not true it is “inaccurate”.

Warranties: are promises of indemnity if the representation/assertion is false, i.e. they give rise to breach of contract and a potential claim for damages/losses if the representation proves to be inaccurate. The terms “representation” and “warranty” are often used together in practice. If a warranty is not true it is “breached”.

Assignment: the transfer of a right from one person to another. The benefit of a contract is a right and, in principle, can be freely assigned by the benefitting party. The burden of a contract cannot be assigned, even though parties often o act as though it can be by having the assignee take over the remaining performance of the contract from the assignor. In legal terms, however, such dealings are classified differently.

Novation: is a means of transferring a party’s rights and obligations under a contract to a third party. Strictly speaking, the original rights and obligations are not transferred: novation extinguishes one contract and replaces it with another, under which a third party takes up rights and obligations which duplicate those of one of the parties to the original contract.

The Panel on Takeovers and Mergers: key regulatory body responsible for supervising and regulating public takeovers in the UK and issuing and enforcing the Takeover Code.

The Financial Conduct Authority: regulates the financial services industry in the UK. Its role includes protecting consumers, keeping the industry stable, and promoting healthy competition between financial service providers. The FCA is tasked with enforcing most of the rules concerning listed companies, including the Listing Rules, the Disclosure and Transparency Rules and the Prospectus Rules.

CMA/European Commission: for investigation of mergers which may give rise to competition concerns throughout the EU.

6. Trainee Overview

Watch this video to hear one of our trainees give an overview of the M&A practice and explain the type of work trainees typically carry out during their time in the department.