Information hub

All the latest views and news here

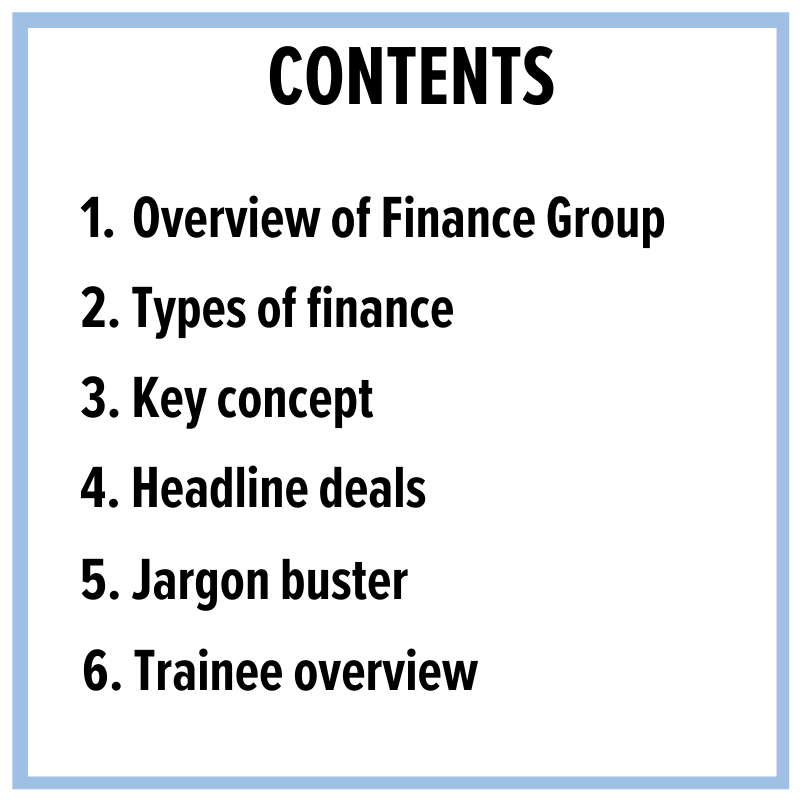

A Student’s Guide to Bank Finance

1. Overview of Finance Group London

The Finance Group in London specialises in debt finance transactions. Debt finance is where companies borrow money from banks to use for a range of corporate purposes, including:

- To raise funds in order to take-over another company;

- To acquire certain assets, for example factories or aircraft;

- To re-finance existing debt, which often happens when interest rates are lower (i.e. the company borrows cheap money to pay off older, more expensive loans); and

For general day-to-day corporate expenses.

In return for the company accessing the amount of the loan (the “principal”), the lender will make money by charging a specified percentage of the principal (the “interest”). The interest is usually paid by the borrower when it makes repayments of the principal. Lenders can also make money from fees for administrating the loan.

The Finance Group conducts transactions for both borrower clients and lender clients – though not on the same deal as that would be a conflict of interest! Clients are typically large companies, banks, hedge funds, private equity houses, sovereign wealth funds and governments.

Finance work is truly interdisciplinary. The Finance Group might work with the M&A practice when a company is borrowing to fund an acquisition, with the Capital Markets practice when a company is issuing a bond or with the Project Development & Finance practice where the deal involves infrastructure or energy assets.

2.Types of Finance

Given that a borrower might use a loan for many different things, it is only fitting that there are many different types of finance, for example:

- Leveraged finance: the purchase of an asset or business using a large proportion of debt borrowed from a bank, or more likely a group of banks (a “syndicate”). The borrower will normally already have a high ratio of debt to equity or a sub-investment grade credit rating, and leveraged financing is a common method of acquisition finance (particularly in private equity).

- Debt capital markets: advising clients who wish to raise money in the international capital markets, for instance in the issuance of bonds in order to raise funds. Issuing a bond on the debt capital markets is often highly prestigious for a company. Usually, there will be a large pool of investors who buy the bond – this minimises each investor’s individual exposure to risk as it is spread throughout a wider group.

- Structured finance: highly complex financial transactions for companies or multinationals that require bespoke financial arrangements for their particular purposes. The financing needs of such companies normally call for more than conventional products such as a loan.

- Derivatives & structured products: An arrangement or product (for example a future or option) whose value derives from the value of an underlying asset. The value of a derivatives contract will fluctuate in step with the value of the particular chosen asset (such as bonds, shares, currencies or interest rates). Such arrangements are usually “hedges”, which are used by a company to guard against the risk inherent in being exposed to fluctuating asset values or exchange rates. For example, hedging can be useful where a company makes a large amount of profits in one currency but has to pay back its loans in another.

3. Key Concept: Project Management

Project management is a crucial skill for a lawyer in any transactional department. Being able to run one or more work-streams for a particular matter, while staying on top of the work, is an important trainee role and organisational skills are paramount.

A trainee will often be responsible for managing the conditions precedent (CP) process, which is a list of requirements that must be satisfied before the borrower can borrow under the loan (“drawdown” or “utilisation”). The CPs are normally listed in a schedule to the loan agreement and vary depending on the transaction. As a minimum, lenders usually want to see:

- proof that the borrower is validly incorporated and is registered as a company;

- proof that the borrower is permitted to enter into the loan, e.g. in the form of corporate authorisations such as board and shareholder resolutions;

- evidence that related documents (e.g. security agreements, agreements between lenders etc.) will be in agreed form or executed on or before drawdown; and

- legal opinions from lawyers confirming that the borrower is validly incorporated and can enter into the loan (“capacity opinions”) or confirming that the obligations in the loan agreement and related documents are binding on the parties and enforceable in court or arbitration proceedings (“enforceability opinions”).

Senior lawyers in the team will rely on the trainee to know the status of each CP and to be up to date with the progress at all times. Running the CP process usually involves:

- managing a checklist to keep tabs on each CP item;

- requesting the required documents from relevant parties;

- negotiating documents and preparing the documents for which your client is responsible;

- leading conference calls with the client and the other side’s counsel to keep all parties updated as to progress; and

- liaising with other departments, for example Tax, to provide technical legal advice.

Alternatively, when advice is required on foreign law issues for a particular deal, a trainee may be asked to take control liaising with local counsel in multiple jurisdictions, which can be a challenge to juggle and again requires high levels of organisation. Typically, local counsel is involved to advise when a borrower is granting non-English security as part of the transaction. Trainees are often in-charge of following up to make sure that security documents and any registration formalities are completed within the necessary timeframes.

4. Headline Deals

Nokia

Shearman & Sterling advised Nokia on its €1.5 billion five-year multicurrency revolving credit facility (RCF). Nokia introduced a sustainability pricing mechanism linking the margin of the RCF to two of its key sustainability targets – reduction of greenhouse gas emissions attributed to Nokia’s operations and reduction of greenhouse gas emissions attributed to Nokia’s customers’ use of Nokia’s products.

Boston Scientific Corporation

Shearman & Sterling advised Boston Scientific Corporation, as borrower, on a $2 billion unsecured term loan facility agented by Barclays Bank PLC to refinance the outstanding commitments under a bridge credit agreement and to finance the acquisition of BTG plc, a company which acquires, develops, manufactures and commercializes pharmaceutical products internationally.

Shearman & Sterling also advised Boston Scientific Corporation, as borrower, on a $2.75 billion unsecured revolving credit facility agented by Wells Fargo Bank, National Association.

Boston Scientific Corporation, headquartered in Marlborough, MA, develops, manufactures and markets medical devices for use in various interventional medical specialties worldwide.

5. Jargon Buster

Bond – A debt instrument which is usually issued on the debt capital markets. In return for investing, the borrower will pay the investor interest (the “coupon”) throughout the life of the loan as well as the face-value of the bond on redeemed.

Collateral – Property or other assets that a borrower offers a lender to secure a loan. If the borrower ceases to make the promised loan payments, the lender can seize the collateral. Collateral is basically the same as security, but is a term more commonly used in US-law transactions.

Conditions Precedent – A condition that must be satisfied by the borrower before it may request a drawdown of funds under the loan agreement.

Facility agreement – An agreement in which a lender (usually a bank or other financial institution) sets out the terms and conditions on which it is prepared to make a loan available to a borrower. The facility agreement could be a term loan where the lenders make a payment to the borrower which is to be paid back over a certain period. Alternatively, it could be a revolving-credit-facility (“RCF”) which allows a borrower to borrow and pay-back the principal as it requires – a concept similar to an overdraft.

Future – A financial contract obliging the buyer to purchase an asset (or the seller to sell an asset), such as a physical commodity like coffee, at a predetermined future date and price.

Investment grade loans – A loan made to a borrower with a good credit rating. A borrower’s credit rating is determined by a rating agency or, in some cases, more than one agency. Standard & Poor’s ratings for investment grade loans range from ‘AAA’ to ‘BBB-‘.

Leverage – The amount of debt used to finance a company’s assets. A company with significantly more debt than equity (i.e. shares) will be a highly leveraged company.

Margin – The rate of interest which is applicable to the loan.

Option – A financial contract offering the buyer the right, but not the obligation, to buy or sell a security or other financial asset at an agreed price on a specific date.

Security – An asset used to guarantee the repayment of a loan, satisfaction of an obligation, or in compliance of an agreement. Security gives a lender a legal right of access to the secured asset and to take possession and title of this asset in case the borrower can’t pay back the loan (“defaults”).

Security / collateral agents – A financial institution that holds the collateral on behalf of the lenders under a syndicated loan agreement as security for performance of the borrower’s obligations under the loan agreement. The borrower grants a security interest in the collateral to the collateral agent on behalf of all of the lenders, and the collateral agent takes all necessary actions with respect to the collateral on behalf of the lenders.

Sub-investment grade loans – A loan made to a borrower with a poor credit rating. Standard & Poor’s ratings for sub-investment grade loans range from ‘BB+’ to ‘D’.

Syndicated loan agreement – A loan offered by a group of lenders (a syndicate) who together provide funds for a single borrower.

6. Trainee Overview